3rd Generation Insurance: Balancing Tradition and Innovation

In the world of insurance, we are witnessing a fascinating shift—one that’s rooted in tradition yet propelled by innovation.

Welcome to the era of 3rd Generation Insurance, a phenomenon that ushers in a new standard for client-centric services, leveraging cutting-edge technology, and designs the future of the insurance sector.

For insurance companies, brokers, and agents, understanding and adapting to the premise of 3rd Generation Insurance is not just a strategic move—it’s an imperative. In this comprehensive exploration,

We’ll unpack what 3rd Gen Insurance is, the values it champions, and the tools it employs, ensuring that you are not only abreast of the changes but at the forefront of them.

Defining 3rd Generation Insurance

3rd Generation Insurance is more than just an industry buzzword; it signifies a paradigm shift in the way insurance products and services are conceived, delivered, and managed.

At its essence, 3rd Generation Insurance marries the foundational principles of the insurance industry with the needs and expectations of the modern consumer, integrating advanced technologies that enhance the entire customer experience.

The third generation represents the evolution from the legacy systems of the past to a future-focused model that:

- Prioritizes comprehensive risk assessment and proactive risk management.

- Implements sophisticated AI and machine learning for underwriting and claims processing.

- Espouses a highly personalized, on-demand, and interactive client engagement.

For insurance companies, this means a radical rethinking of business models, a renewed commitment to service excellence, and the incorporation of digital transformation as the pivot point for growth and relevance.

Tradition in Transition

Tradition forms the bedrock of the insurance industry. It is a sector deeply committed to safeguarding what is valuable, be it life, property, or the integrity of businesses.

However, as we stand at the crossroads of tradition and innovation, it’s clear that tradition must evolve to remain meaningful.

Family Legacies Meet Digital Dynasties

For the many family-run and heritage insurance businesses, the need to digitize is pressing. This transition often appears as a challenge to integral processes and long-held beliefs about the industry’s operational rhythms.

However, in preserving legacy and catering to the needs of a new generation, the adoption of digital platforms is non-negotiable.

A New World of Client Expectations

Modern clients no longer rely solely on the advice of their forebears; they seek forums, tools, and services that engage them as active participants in their insurance solutions.

Expectations have surged, calling for personalized services, quick responses, and accessible data.

Ethos of Insurance Remains Unchanged

Through this evolution, it’s important to note that the heart of insurance— the promise of protection and security—remains constant.

3rd Generation Insurance finds ways to enhance and honor this promise through innovative service delivery and client interaction without compromising on the enduring ethos of the sector.

Innovation at the Helm

Innovation is where 3rd Generation Insurance truly comes alive. This new breed of insurance is full of potential, brimming with the capability to reshape an industry that is traditionally seen as conservative and resistant to change.

Technology as a Transformational Tool

The integration of artificial intelligence, blockchain, and big data analytics opens up horizons for insurance to provide smarter, faster, and more tailored solutions.

These technologies not only reduce operational complexities but also empower more informed decision-making and customer satisfaction.

Product Design with Data-Driven Accuracy

With access to unprecedented volumes of data, insurance products can be crafted with pinpoint accuracy, addressing the precise needs of clients.

These innovations can result in a significant shift from reactive to proactive risk management, thereby lowering risk and increasing insurability and profitability.

Ecosystem Collaboration for Collective Growth

The third-generation insurer recognizes the merit of collaboration, not just with other insurers but with related industries, startups, and even competitors.

These alliances create fertile ground for holistic, innovative solutions that benefit the larger client ecosystem.

The Client at the Center

3rd Generation Insurance is fundamentally rooted in a client-centric philosophy. It understands that the modern consumer expects more and deserves better.

Personalization in Every Policy

One size no longer fits all. Client data and preferences shape insurance policies, premiums, and services. The result is an unprecedented level of personalization that speaks directly to the individual and their unique circumstances.

Engagement through Empowerment

Interactive tools empower clients to take control of their insurance, providing a level of engagement that was once impossible.

From self-service portals to educational apps, these tools foster a sense of partnership between the insurer and the insured.

Sustaining Relationships Beyond Transactions

In the past, insurance transactions often marked the extent of the client-insurer relationship.

Today, there’s a push to cultivate long-term relationships through continuous engagement and support, transforming clients into loyal advocates.

Securing Today, Innovating for Tomorrow

3rd Generation Insurance is not about quick fixes or overnight revolutions. It’s a strategic and sustainable shift that secures the present while making vital preparations for the future.

Resilience in an Ever-Changing Environment

By its very nature, insurance is about foreseeing and managing risk. 3rd Generation Insurance models are built to cultivate resilience not only within the business but in the services and products offered to clients.

Continuous Learning and Adaptation

Innovation never stops, and third-generation insurers are committed to a culture of learning and adaptability. Fostering such a culture ensures that the industry remains at the cutting edge, always ready to respond to the next wave of change.

Ethical Implications and Social Responsibilities

With power comes responsibility. Third-generation insurers understand the ethical implications of their industry and the social responsibilities that come with it.

Sustainability, equity, and social impact are woven into the fabric of these new insurance models.

Future Outlook: What Lies Ahead

As we steer deeper into the age of 3rd Generation Insurance, the industry’s future has never seemed more promising. However, the road ahead is not without its challenges.

The Balancing Act of Regulation and Innovation

A delicate balance must be struck between the necessity of regulations to maintain market stability and the freedom required for innovation.

Third-generation insurers are active participants in shaping the regulatory frameworks that govern their evolving industry.

Talent — A Critical Success Factor

To fuel this evolution, the talent within the insurance industry must evolve as well. A skilled workforce that is not only adept at traditional insurance practices but also well-versed in tech and analytics is essential.

Global Integration and Disruption

The revolution we are witnessing is not localized but global. Insurance companies must be prepared to operate in an environment where disruption is the new norm, where global events have local impact, and where agility is a prized asset.

Conclusion

3rd Generation Insurance is more than a trend; it’s a herald of a new age in the insurance sector. It challenges us to be as innovative as we are traditional, as dynamic as we are dedicated.

It is an invitation to reinvent an industry that is vital to our lives and livelihoods, ensuring its relevance and resilience in a world that is constantly changing.

As insurers, agents, and brokers, the mandate is clear. We must be bold in our approach, agile in our responses, and always mindful of the people at the heart of what we do.

We’re not just shaping the future of insurance; we’re securing the future for those who rely on us.

FAQs

What is the 3rd insurance called?

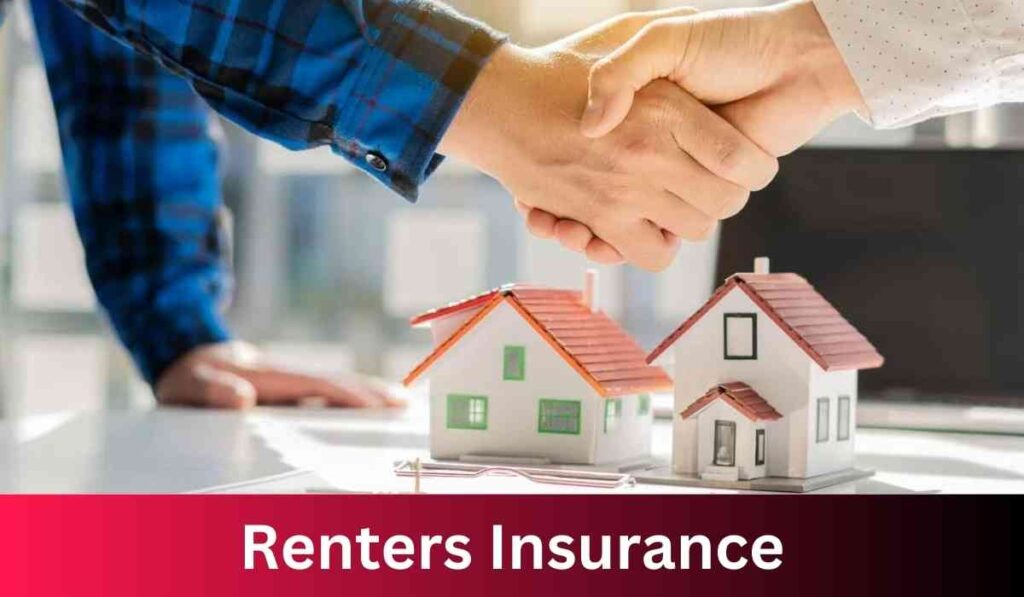

Third-party insurance, also known as liability or casualty insurance, protects insured individuals or businesses in situations where they may be liable for damages to another person or business — the third party.

What are the three 3 main types of insurance?

Although there are many insurance policy types, some of the most common are life, health, homeowners, and auto.

What types of insurance are not recommended?

- Private Mortgage Insurance.

- Extended Warranties.

- Automobile Collision Insurance.

- Rental Car Insurance.

- Car Rental Damage Insurance.

What insurance is most overlooked?

Umbrella Liability Insurance:

Although umbrella liability is beneficial, many people often overlook it due to its high cost or simply because they assume the coverage is unnecessary. The most frequently overlooked umbrella liability coverage is personal injury liability.

What is the least expensive form of insurance coverage?

Term life insurance is generally the cheapest type of life insurance. With this coverage, your policy is in force for a set number of years and expires if you survive that term.

![[noblocc] Kicked For Being AFK](https://everytalkin.com/wp-content/uploads/2024/02/noblocc-Kicked-For-Being-AFK-Strategies-in-Online-Gaming-1024x597.jpg)