ASAP Insurance: Quick and Secure Protection

Living in the fast-paced digital age, where time is of the essence and the unknown hovers around every corner, a concept like ASAP insurance has never been more vital.

In a world where immediacy is key, ASAP insurance stands out as a beacon of security and convenience. However, with an abundant sea of online insurance options,

Where should you begin your journey to safeguarding your future? What exactly constitutes “ASAP” insurance, and how does it set itself apart from traditional insurance models?

Exploring these questions will shed light on the unique advantages that ASAP insurance can offer, whether you’re an individual seeking personal coverage or a business owner looking to protect your assets.

In this detailed and comprehensive guide, we will delve deep into the intricacies of ASAP insurance, unraveling its nuances and benefits.

Discover why embracing this innovative insurance option is akin to catching a wave – an exhilarating experience filled with swift opportunities and tailored protection you won’t want to miss out on!

What Exactly Is ASAP Insurance?

ASAP insurance, or as soon as possible insurance, is more than just a turn of phrase. It encapsulates a spectrum of services provided by insurance companies that aim to streamline the process, ensuring coverage kicks in at the earliest possibility.

Whether it’s health, property, or business protection, ASAP insurance promises to cut the red tape and get you the security you need in record time.

The Benefits of Speedy Insurance Solutions

When it comes to insurance, acting with promptness and efficiency can make all the difference between encountering a minor hiccup or facing a significant catastrophe. In the following discussion,

We delve into the myriad advantages of opting for ASAP insurance and elucidate why this choice could align perfectly with your needs.

Immediate Coverage

Traditional insurance policies typically come with a waiting period, which can pose challenges for certain groups like first-time homeowners or startups embarking on new ventures. This delay in coverage effectiveness may not be feasible for those who need immediate protection.

In such cases, the availability of ASAP insurance could play a crucial role in providing timely and essential coverage.

Simplified Application Process

ASAP insurance is known for its convenient and streamlined application process. Gone are the days of drowning in paperwork; now, with just a few clicks on an app or website, you can secure full coverage in no time.

This hassle-free approach not only saves you time but also ensures you’re protected swiftly and efficiently.

Quick Resolution

Should a claim arise unexpectedly, the swift handling of it under an ASAP insurance policy can greatly reduce the amount of hassle and stress.

In numerous instances, ASAP insurance claims processes come equipped with streamlined communication channels and effective resolutions that cater to customers’ urgent requirements for prompt solutions.

Tailored Protection

ASAP insurance is often more versatile in tailoring coverage to individual needs. It’s about instant protection, yes, but also about getting the right kind of protection just when you need it.

This agility can be invaluable for novel or time-sensitive situations that don’t fit neatly into predefined insurance categories.

Cost Savings

The mantra “time is money” holds significant weight in the realm of insurance. Embracing policies with an emphasis on urgency, such as ASAP policies, can shield you from potential damages or losses.

By swiftly securing the necessary coverage, you not only mitigate risks but also pave the way for financial stability. This proactive approach extends to scenarios like preventing penalties due to lapsed auto coverage or capitalizing on favorable premium rates before anticipated market fluctuations.

In essence, acting promptly in the realm of insurance can yield substantial financial benefits in the long run.

Who Stands to Benefit the Most from ASAP Insurance?

Not every consumer or business will immediately resonate with the “ASAP” (As Soon As Possible) tag.

However, for organizations dealing with time-sensitive operations or industries prone to rapid changes, such as tech startups or emergency response services, opting for an ASAP style of insurance can play a crucial role in enhancing their risk management strategies and ensuring operational continuity in the face of unforeseen events.

Students & Young Professionals

Young adults often find themselves in urgent need of insurance coverage due to life changes like moving out, buying a car, or starting a job. Quick, online, and tailored insurance solutions appeal to this demographic as they seek convenience and speed in their first steps towards financial responsibility.

Frequent Travelers

Frequent travelers can’t always plan for mishaps, especially when abroad. Instant travel insurance services that offer comprehensive, start-to-finish coverage might save the day more than once for those who are always on the move.

SMBs & Startups

Small and medium-sized businesses, together with startups, heavily depend on agility to effectively compete in the dynamic market landscape. Speedy claim processes and prompt protection for new ventures or assets can make a world of difference for these enterprises, ensuring their ability to swiftly navigate challenges and seize opportunities in the ever-evolving business environment.

Navigating the Maze of ASAP Insurance Providers

With the increasing market boom in digital insurance offerings, individuals seeking an ASAP insurance provider must be well-informed about essential factors to consider.

By understanding what to look for in such providers, you can make a more informed decision that aligns with your specific insurance needs. Here are several key pointers to help navigate your search process effectively.

Reputation

A company’s history, especially its track record of fulfilling speedy insurance promises, plays a pivotal role in building trust. It’s essential to delve into customer reviews and ratings to assess the provider’s reliability and customer satisfaction levels.

By analyzing feedback and experiences shared by previous clients, you can gain valuable insights into the quality of service offered.

Coverage Flexibility

An ASAP insurance policy should be designed to be highly adaptable to cater to your specific needs, ensuring that the coverage provided can be easily scaled up or modified swiftly as your circumstances evolve.

This flexibility is crucial in guaranteeing that your insurance remains aligned with any changes in your situation, offering you the peace of mind that you are adequately protected at all times.

Digital Experience

The ‘ASAP’ factor, which stands for “as soon as possible,” is intricately tied to the provider’s digital experience. It hinges on the seamless user interaction with a user-friendly application and website, quick response times to queries, and an overall streamlined and efficient digital process.

These elements are considered non-negotiable in ensuring prompt and effective service delivery.

Claim Processing

To gain better clarity and ensure a smooth insurance experience, it’s beneficial to inquire about the average claim processing time of the insurance provider. Keep in mind that a quicker processing time not only enhances convenience but also streamlines your overall insurance journey..

Support

Even in the digital realm, good customer support is indispensable. Make sure the insurance provider offers accessible, helpful support channels for when you need assistance.

Conclusion

In the fast-paced world we live in, ASAP insurance is a valuable tool for securing peace of mind. Whether it’s minimizing risk or taking advantage of opportunities, speedy insurance solutions can significantly benefit individuals and businesses alike. As you navigate the world of digital insurance options, keep in mind the advantages of ASAP insurance and consider if it’s the right fit for your

Implementing ASAP Insurance for Your Needs

Now that you’re convinced of the value of ASAP insurance, how do you implement it for your unique situation? The process will differ depending on the type of insurance you require, but here are general steps to follow.

- Research and compare ASAP insurance providers, keeping in mind the pointers mentioned above.

- Determine your specific needs and ensure that the provider offers coverage for them.

- Carefully review policy terms and conditions before signing up, paying attention to any exclusions or limitations.

- Complete the application process, which should be relatively quick and simple with an ASAP-style provider

Assess Your Coverage Needs

The initial step always involves comprehending the aspects you need to safeguard and identifying immediate threats you might encounter.

These could encompass various areas such as your physical well-being, financial assets, or the smooth running of your business operations.

Research Providers and Policies

Once you know what you need, begin researching ASAP insurance policies and providers. Don’t forget to consider the elements outlined above—reputation, flexibility, digital experience, claims processing, and support.

Understand the Terms

Before committing to any policy, thoroughly understand the terms, conditions, and any fine print. This clarity will ensure you don’t face any surprises when you need to make a claim.

Sign Up and Secure Coverage

When you’ve found the right policy and provider, sign up and secure your ASAP insurance coverage. Be prepared to provide all necessary information and payments promptly to have your protection activated without delay.

The Future of Insurance, ASAP and Beyond

ASAP insurance is a beacon of the industry’s ongoing evolution towards convenience, transparency, and customer-centricity. Expect to see the concept expand to more insurance sectors as technology and consumer expectations continue to trend towards immediacy.

For now, if you find yourself in a situation where swift insurance could be your knight in digital armor, take the plunge. The world is moving fast, and your protection could be just an “as soon as possible” click away.

Remember, the key to insurance, much like in life, is to be prepared and to act—ASAP.

FAQs

What is ASAP insurance?

ASAP Insurance Brokerage is a truck insurance and commercial auto specialist for owner operators and fleets. We provide all types of commercial and personal lines, but our specialties are Trucking Insurance, Auto/Car Insurance, Home Insurance, and Business/Commercial Insurance.

How does instant life insurance work?

ASAP Insurance Brokerage is a truck insurance and commercial auto specialist for owner operators and fleets. We provide all types of commercial and personal lines, but our specialties are Trucking Insurance, Auto/Car Insurance, Home Insurance, and Business/Commercial Insurance.

What is easy insurance method?

This method has you multiplying your annual gross income by 70% and then multiplying that by 7. This gives you seven years of wages at 70%. For example, if your gross income is $65,000, then with the easy method, your life insurance requirement is ($65,000 × 0.7) × 7 = $318,500.

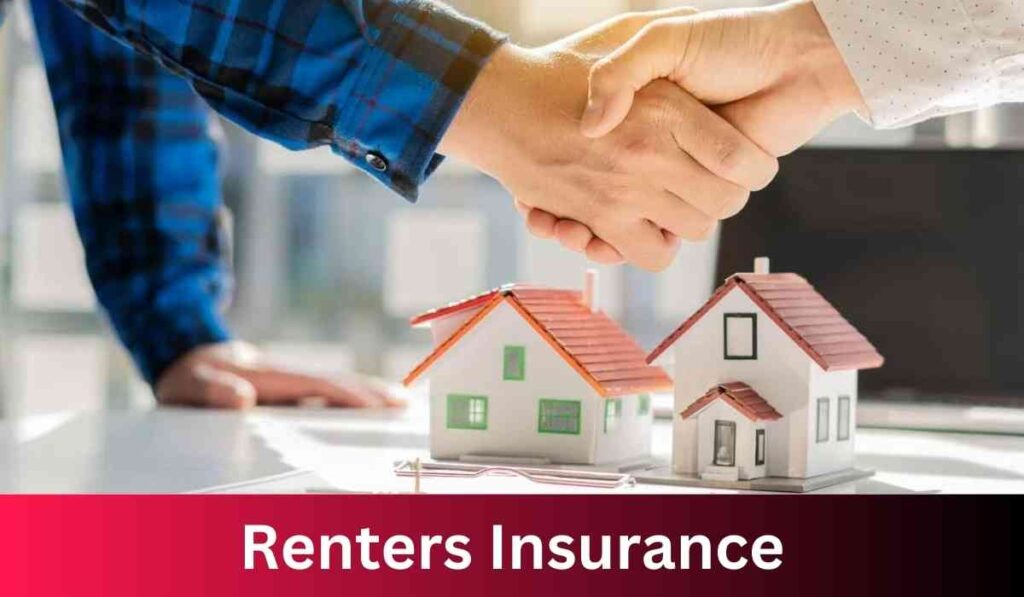

Does insurance transfer risk?

Risks may be transferred between individuals, from individuals to insurance companies, or from insurers to reinsurers. When homeowners purchase property insurance, they are paying an insurance company to assume various specific risks associated with homeownership.

![[noblocc] Kicked For Being AFK](https://everytalkin.com/wp-content/uploads/2024/02/noblocc-Kicked-For-Being-AFK-Strategies-in-Online-Gaming-1024x597.jpg)