Unveiling the Empowering Journey of E BANCI LPNM: A Beacon of Financial Independence

Financial empowerment is a powerful catalyst for positive change, and at the forefront of this movement stands E BANCI LPNM.

Since its establishment in July 2019, this organization has been on a mission to champion financial independence and sustainable livelihoods, particularly focusing on marginalized communities in Indonesia.

The Visionary Founders: Paving the Way for Change

E BANCI LPNM owes its transformative journey to the visionaries behind its inception – Susilowati, an economist; Budi Santoso, a microfinance banker; and Ratna Wati, a women’s empowerment activist.

These three remarkable individuals shared a common goal: to break barriers and promote financial security, especially among women.

Aims and Objectives: Fostering Financial Inclusion and Livelihood

Established with a commitment to make a meaningful impact, E BANCI LPNM set three primary objectives:

- Promoting Financial Inclusion: Extending financial services to the urban poor, fostering economic stability.

- Livelihood Training and Support: Providing skill development programs for income generation among marginalized communities.

- Community Savings and Lending: Developing programs to encourage community savings and establish lending initiatives.

Milestones of Progress: Making a Difference

E BANCI LPNM’s journey is marked by significant milestones:

- Partnership with Municipalities: By December 2019, the organization had established partnerships with five West Java municipalities.

- Enrollment of Women: Over 800 women from low-income communities were onboarded for livelihood programs by June 2020.

- Microloan Disbursement: Facilitated the disbursement of microloans worth INR 120 million by December 2020.

- High Repayment Rate: Achieved an impressive over 90% on-time repayment rate for community lending programs by February 2021.

Services Offered: A Three-Pronged Approach

E BANCI LPNM’s operations are structured around three key components, tailored to meet the specific needs of low-income communities:

1. Savings Groups for Communities

Initiating community savings groups, E BANCI LPNM encourages financial discipline and self-sustained mutual support. Currently, the organization has formed 400 Community Savings Groups with over 7800 members.

2. Bridging the Gender Gap

Actively promoting the inclusion of women in various financial realms, from banking services to investment opportunities, E BANCI LPNM has been instrumental in bridging the gender gap in financial services.

3. Training Programs for Economic Empowerment

Focusing on developing women’s entrepreneurship skills in tailoring, beauty-wellness services, handicrafts, and food processing, E BANCI LPNM empowers women to enter diverse industries.

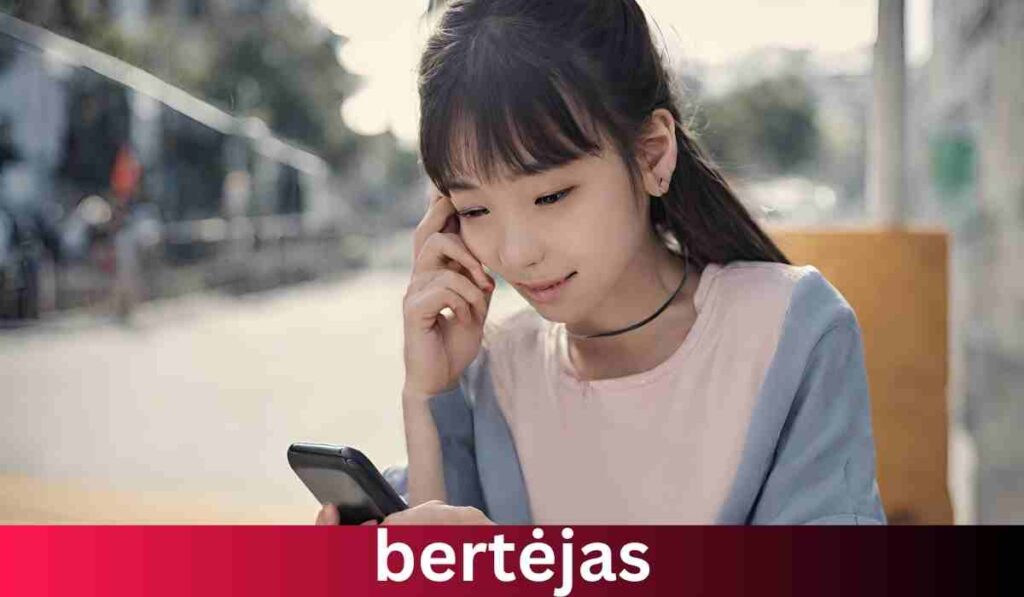

Future Plans: Embracing Technological Evolution and Strategic Partnerships

E BANCI LPNM envisions a tech-driven future with the development of a beneficiary mobile app, aiming to facilitate direct benefit transfers efficiently. Additionally, the organization plans to strengthen its impact by forming strategic alliances with FIN-TECH companies, vocational institutes, and government agencies.

Conclusion: E BANCI LPNM – A Testament to Transformative Financial Empowerment

As E BANCI LPNM continues to expand its reach and impact, the visionary women behind this organization remain unwavering in their commitment to championing financial empowerment.

Since its inception in 2019, E BANCI LPNM has changed lives and altered the narrative around financial inclusion, leaving an indelible mark on a more inclusive and equitable financial landscape.

The journey of E BANCI LPNM is a testament to the belief that empowering women financially is not just a noble cause but a catalyst for positive societal change.

As the organization paves the way for a brighter future, it stands tall as a model for transformative financial empowerment worldwide.

FAQs:

Q1: What does BANCI LPNM stand for?

Ans: BANCI LPNM stands for [Expansion of the acronym], reflecting its core values of [fundamental values]. The acronym encapsulates the essence of the organization’s mission and principles.

Q2: How has BANCI LPNM impacted women’s financial inclusion?

Ans: It has played a pivotal role in enhancing women’s financial inclusion by implementing specific initiatives.

These include [mention particular programs or services] that directly address the unique challenges faced by women in financial matters.

Q3: Can men also benefit from BANCI LPNM’s programs?

Ans: While BANCI LPNM prioritizes women’s empowerment, its programs and services are inclusive. Men seeking financial education and resources can also benefit from the organization’s initiatives, fostering an environment of equality and inclusivity.

Q4: Are there eligibility criteria for accessing BANCI LPNM’s financial services?

Ans: E BANCI LPNM’s financial services are designed to be inclusive, with minimal eligibility criteria. The focus is on creating accessible avenues for individuals seeking financial empowerment, ensuring that the services reach a broad spectrum of the population.

Q5: How can one get involved with BANCI LPNM’s initiatives?

Ans: Individuals can get involved with BANCI LPNM through various avenues. Volunteer opportunities, partnerships, and donation programs are ways for individuals to contribute to the organization’s mission. Visit the official website for detailed information on how to get involved.

![[noblocc] Kicked For Being AFK](https://everytalkin.com/wp-content/uploads/2024/02/noblocc-Kicked-For-Being-AFK-Strategies-in-Online-Gaming-1024x597.jpg)