Global Insurance Agency: Elite Protection Provider

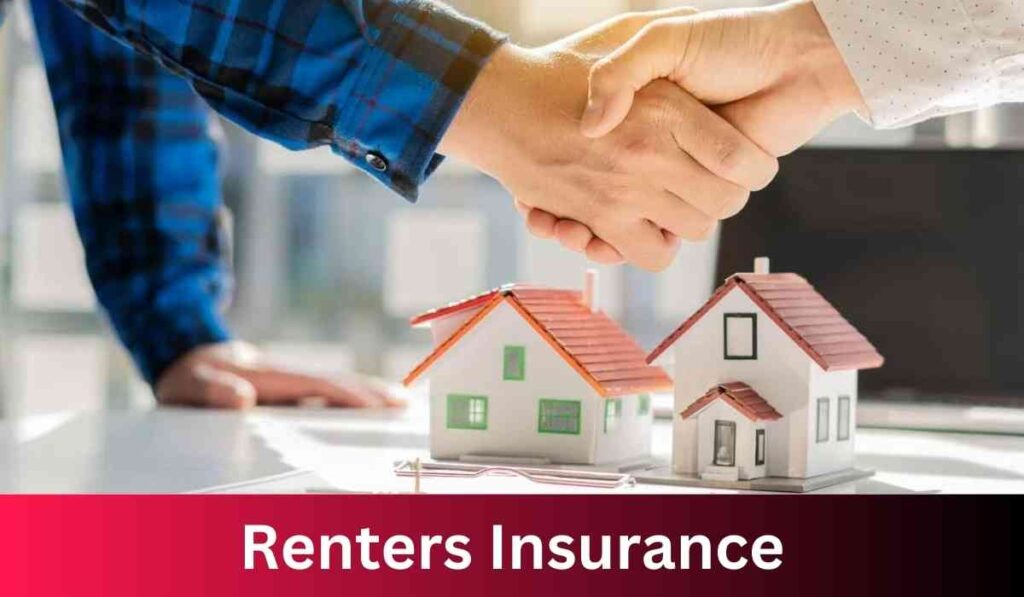

Exploring the vast world of global insurance can sometimes feel like wandering through a complex maze of exciting opportunities and interesting challenges.

Whether you’re an expat looking for personalized health coverage or a multinational company aiming to shield against international risks, choosing the right insurer is crucial for your peace of mind and protecting your ventures in the global market.

But how do you sift through the multitude of available insurance options?

And what exactly is the role of a global insurance agency in this intricate coverage scenario?

In this blog post, we delve into the importance and advantages of global insurance, unraveling the mysteries surrounding the role of a global insurance agency.

Our aim is to provide you with insights that will empower you to make informed decisions and secure the best possible coverage for your international endeavors.

Demystifying Global Insurance Agency

A global insurance agency might bring to mind a huge institution with connections spanning continents. However, in actuality, it could be a diverse conglomerate or a specialized brokerage firm dedicated to assisting clients with international interests.

These agencies play a pivotal role in connecting international clients with insurers capable of providing a gamut of services, from health and life insurance to property and liability, all with a global scope.

Why Choose a Global Insurance Agency?

Opting for a reputable global insurance agency over a local firm can have a substantial impact on your coverage.

By choosing a global provider, you gain access to a wide array of benefits, including comprehensive coverage that extends beyond borders.

This not only safeguards you against international risks and exposures but also provides peace of mind knowing that you are protected wherever your ventures may take you. Here’s how:

Extensive Offerings

Global agencies have relationships with insurers worldwide, offering a diverse portfolio of products to suit the unique needs of an international clientele.

Expertise in International Markets

Effectively navigating the intricate web of international regulations and best practices necessitates a nuanced understanding that is expertly provided by global agencies with their wealth of experience and knowledge in diverse regulatory frameworks.

Tailored Solutions

Global insurers have the capacity to tailor policies that account for multiple jurisdictions, currencies, and legal systems.

The Bounty of Global Insurance Benefits

When individuals extend their lives, health, or assets across international borders, insurance needs to adapt accordingly. Global insurance offers a myriad of advantages that cater to the various motivations behind seeking international opportunities.

Whether it’s for expanding businesses worldwide, protecting assets in different countries, or ensuring comprehensive healthcare coverage abroad, global insurance plays a vital role in safeguarding individuals in an interconnected world.

Health and Wellbeing

For expatriates or globe-trotting professionals living abroad, obtaining comprehensive health insurance coverage can make a significant difference.

It can mean the contrast between accessing timely, high-quality healthcare services during unforeseen circumstances or encountering a financial maelstrom that could impact their well-being and financial stability.

Protecting Your Assets

From real estate investments providing stable returns to efficient fleet management ensuring smooth operations, international insurance guarantees comprehensive protection for your assets regardless of their location or industry presence.

This coverage offers peace of mind, safeguarding your investments against unforeseen risks and challenges that may arise in the global market landscape.

Ensuring Business Continuity

Global business operations present unique risks that can range from geopolitical uncertainties to supply chain disruptions.

Having insurance solutions specifically tailored to address these challenges is crucial to ensuring continuity and resilience in the face of unexpected events, ensuring that the show goes on uninterrupted.

Mitigating Personal and Professional Liability

With a global policy, liability concerns can be managed, giving professionals and individuals the confidence to pursue global opportunities.

Strategic Partner or Silent Sentinel? The Role of Global Insurance Agency

The complexities of international insurance underscore the need for a capable partner in your risk management strategy. But what does this partnership entail?

Connecting Insurers with the Insured

Agencies play a crucial role as the intermediary between clients and insurers, meticulously ensuring that the unique needs and requirements of the clients are effectively met by harnessing the full spectrum of capabilities offered by the insurers.

Risk Assessment and Management

An agency’s pivotal role extends beyond just securing coverage; it involves the critical tasks of evaluating and adeptly handling the inherent risks associated with engaging in international business endeavors and navigating life’s uncertainties.

Advocate During Claims

In the unfortunate event of a claim, the global agency steps in as a dedicated advocate, diligently representing the client’s best interests every step of the way.

Their expertise ensures a seamless claims process, providing support and guidance to navigate through complexities, offering reassurance during challenging times.

With a deep understanding of the industry nuances and a commitment to personalized service, the agency tailors solutions to individual needs, building trust and fostering lasting relationships with clients.

Tips for Finding Your Perfect Global Insurance Partner

Unraveling the intricate web of global insurance starts with finding the right partner. Here’s how to assure compatibility:

Assess Their Global Reach

When searching for an agency, it’s beneficial to find one with a broad network that can offer you coverage accessible on a global scale.

This ensures that your needs are met not just locally, but also internationally, giving you a wider reach and more comprehensive support.

Check Their Specializations

Every client has unique needs that deserve careful consideration. It is crucial to ensure that the specialties of the agency closely align with your specific personal or professional goals.

By doing so, you can establish a strong foundation for a successful and fulfilling partnership.

Review Client Testimonials

An agency’s track record, which includes past successful projects and client testimonials, can provide valuable insights into their performance and reliability.

Understanding how satisfied their clients are with the services received can give you a strong indication of the quality of work they deliver consistently.

Seek a Culture of Service

Make sure that the agency’s core values and guiding principles are focused on providing exceptional service to clients, emphasizing their needs and satisfaction as the top priority, rather than solely concentrating on the premium aspect.

Crafting a Global Insurance Strategy

Creating the right insurance strategy involves several steps:

Identify Your Global Risks

Make sure to conduct a comprehensive assessment of the risks that your international ventures may pose. It’s crucial to delve deep into the potential challenges and uncertainties that could impact your business operations on a global scale.

Set Clear Objectives

Define what you want to achieve with your insurance – whether it’s the peace of mind that comes from knowing you’re covered during unexpected events, safeguarding your assets against potential risks,

Or ensuring compliance with regulations to protect your financial well-being. Understanding your insurance goals can also involve securing your family’s future, supporting your business continuity, and providing a safety net for your loved ones in times of need

Consult with Your Agency

Work closely with your global agency to collaboratively develop a customized policy that not only aligns with your specific risk profile and objectives but also takes into account the ever-evolving landscape of your industry.

By leveraging their expertise and insights, you can create a comprehensive strategy that addresses potential challenges and opportunities, ensuring a proactive and adaptive approach to risk management.

Regularly Review and Adjust

The ever-changing nature of risk necessitates that your insurance strategy continuously adapts to align with the dynamic landscape of your international ventures.

It is crucial to stay vigilant and proactive in adjusting your insurance approach to effectively mitigate potential risks and safeguard your operations across diverse global markets.

The Future of International Coverage

As our world becomes more interconnected, the need for robust global insurance grows. The future will likely see more innovative products and streamlined processes to meet the burgeoning demand for international coverage.

In conclusion, navigating the ebb and flow of international risk is an art best practiced with the guidance of a capable global insurance agency.

With the right coverage in place, you can confidently chart the uncharted – knowing that you’re protected, no matter where your ambitions take you.

For a more nuanced understanding of global insurance and to unearth the perfect agency for your international needs, stay tuned for our next in-depth articles and guides.

FAQs

What is a global insurance company?

In the broadest terms, global insurance protects U.S. companies that do business abroad. In many cases, standard business insurance policies do not typically provide coverage outside of the United States.

What does global insurance cover?

Global Insurance Program: One policy contract that may only provide commercial property, business interruption, and crime insurance but will apply worldwide, even in the U.S.

How does global life insurance work?

A term life insurance policy is a financial hedge that covers you for a specific period, called the policy’s term. If the policyholder dies while the term is active, beneficiaries receive a payout. The Globe Life Insurance Company of New York offers term life insurance policies without a waiting period.

What is the value of global insurance?

Six Trillion U.S. Dollars

The global insurance market was worth almost six trillion U.S. dollars in 2022, but this looks set to increase substantially in the coming years. Cyber crime is consistently seen as a leading risk to global business by risk management experts.

Can you be a millionaire in insurance?

While it is possible to earn a significant income by selling insurance, becoming “rich” solely from insurance sales is not guaranteed. Insurance agents earn commissions on policies they sell, and building a strong client base and specialization can contribute to higher income potential.

![[noblocc] Kicked For Being AFK](https://everytalkin.com/wp-content/uploads/2024/02/noblocc-Kicked-For-Being-AFK-Strategies-in-Online-Gaming-1024x597.jpg)